43 what is coupon for bond

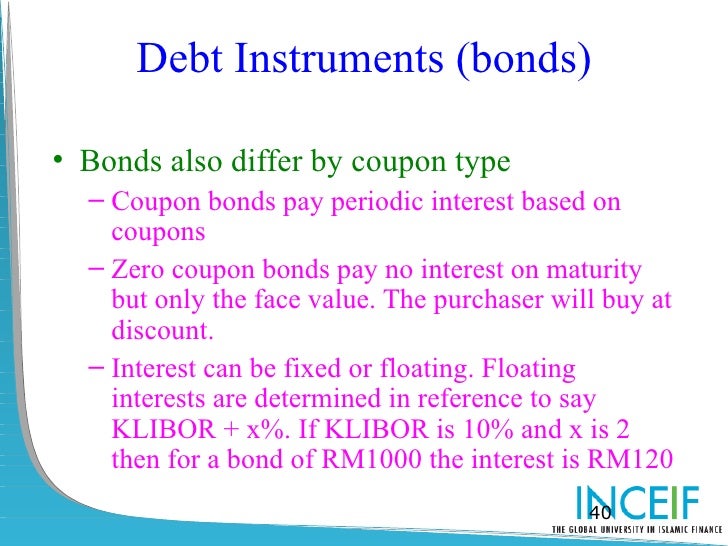

WHAT IS COUPON RATE OF A BOND - The Fixed Income A coupon rate, simply put, is the interest rate at which an investor will get fixed coupon payments paid by the bond issuer on an annual basis over the period of an investment. In other words, the coupon rate on a bond when first issued gets pegged to the prevailing interest rate, and remains constant over the duration of an investment. How to Calculate the Price of Coupon Bond? - WallStreetMojo Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond,

What is Coupon payment | Capital.com It's the annual interest payment made by the issuer of a bond to the bondholder until it reaches maturity. The coupon payment - or simply coupon is expressed as a percentage of the bond's value at the time it was issued. Where have you heard about coupon payment? The term coupon comes from once popular bearer bond certificates.

What is coupon for bond

Coupon Bond - Investopedia Mar 31, 2020 · A coupon bond, also referred to as a bearer bond or bond coupon, is a debt obligation with coupons attached that represent semiannual interest payments. With coupon bonds, there are no records of... Russia Pays Coupons in Rubles With Possible Default Looming Those funds -- about $100 million of bond coupons -- are stuck due to international sanctions, and the grace period to find a solution expires at the end of the day on June 26. At that point ... What Is a Bond Coupon? - The Balance Investors who bought bonds were given physical, engraved certificates before computers simplified much of the financial world. These certificates served as proof that you'd lent money to a bond issuer. You were entitled to receive the principal plus interest. Attached to each engraved bond was a series of bond coupons. Each coupon had a date on it....

What is coupon for bond. What is Coupon Rate? Definition of ... - The Economic Times Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to ... What is a Coupon Bond? - Definition | Meaning | Example Definition: A coupon bond is a debt instrument that has detachable slips of paper that can be removed from the bond contract itself and brought to a bank or broker for interest payments. These detachable slips of paper are called coupons and represent the interest payments due to the bondholder. Each coupon has its maturity date printed on it. Coupon Bond Definition & Example | InvestingAnswers The coupon rate on the bond is 5%, which means the issuer will pay you 5% interest per year, or $50, on the face value of the bond ($1,000 x 0.05). Even if your bond trades for less than $1,000 (or more than $1,000), the issuer is still responsible for paying you $50 per year. How Do Zero Coupon Bonds Work? - SmartAsset What Is a Zero Coupon Bond? A zero coupon bond is a type of bond that trades at a deep discount and doesn't pay interest. While some bonds start out as zero coupon bonds, others are can get transformed into them if a financial institution removes their coupons. When the bond reaches maturity, you'll get the par value (or face value) of the ...

Bond Discount - Investopedia 29.05.2021 · Bond Discount: The amount by which the market price of a bond is lower than its principal amount due at maturity. This amount, called its par value , is often $1,000. As bond prices are quoted as ... Bond Price Calculator Coupon rate is the annual rate of return the bond generates expressed as a percentage from the bond's par value. Coupon rate compounding frequency that can be Annually, Semi-annually, Quarterly si Monthly. Market interest rate represents the return rate similar bonds sold on the market can generate. This figure is used to see whether the bond ... What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond doesn't pay periodic interest, but instead sells at a deep discount, paying its full face value at maturity. Zeros-coupon bonds are ideal for long-term, targeted financial needs ... What Is the Coupon Rate of a Bond? - The Balance Nov 18, 2021 · A coupon rate is the nominal or stated rate of interest on a fixed income security, like a bond. This is the annual interest rate paid by the bond issuer, based on the bond’s face value. These interest payments are usually made semiannually. This article will discuss coupon rates in detail.

Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond . Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value. Coupon Rate - Meaning, Calculation and Importance - Scripbox The bond's coupon rate refers to the amount of annual interest the bondholder receives from the bond's issuer. Coupon rates are a percentage of the bond's face value (par value) and are set while issuing the bond. Moreover, the coupon payments are fixed for a bond throughout its tenure. Coupon Rate = (Total Annual Interest Payments / Face ... What is Coupon in Bonds? : bondspedia - reddit The bond market is full of complex concepts, terminology, and acronyms. In Bondspedia you will know about Bonds. "Bond Glossary" is a one-stop resource for finding the meaning of terminologies and phrases any investor may encounter in the Bond Market. What Is Coupon Rate and How Do You Calculate It? What Is Coupon Rate and How Do You Calculate It? Bond coupon rate dictates the interest income a bond will pay annually. We explain how to calculate this rate, and how it affects bond prices. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators

What Is a Coupon Rate? - Investment Firms A coupon rate, also known as coupon payment, is the rate of interest paid by bond issuers on a bond's face value. Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same.

Coupon Bond - Definition, Terminologies, Why Invest? A coupon bond is a good way of increasing your income over a period of time. Coupon bonds are subjected to taxation in the US. Hence they can be held in a tax-deferred retirement account in order to save investors on paying taxes on the future income.

Talk about value in bonds is getting louder. Here's why, and how to buy ... Taking the real life example of GSBU25, the current YTM of the bond is 3.64%. This means that you will be guaranteed a return of 3.64% if you bought the bond today at $89.10, and held it until 21 November 2025. A side note: the yield to maturity will gravitate towards the coupon rate, and the bond price will gravitate towards $100 as we get ...

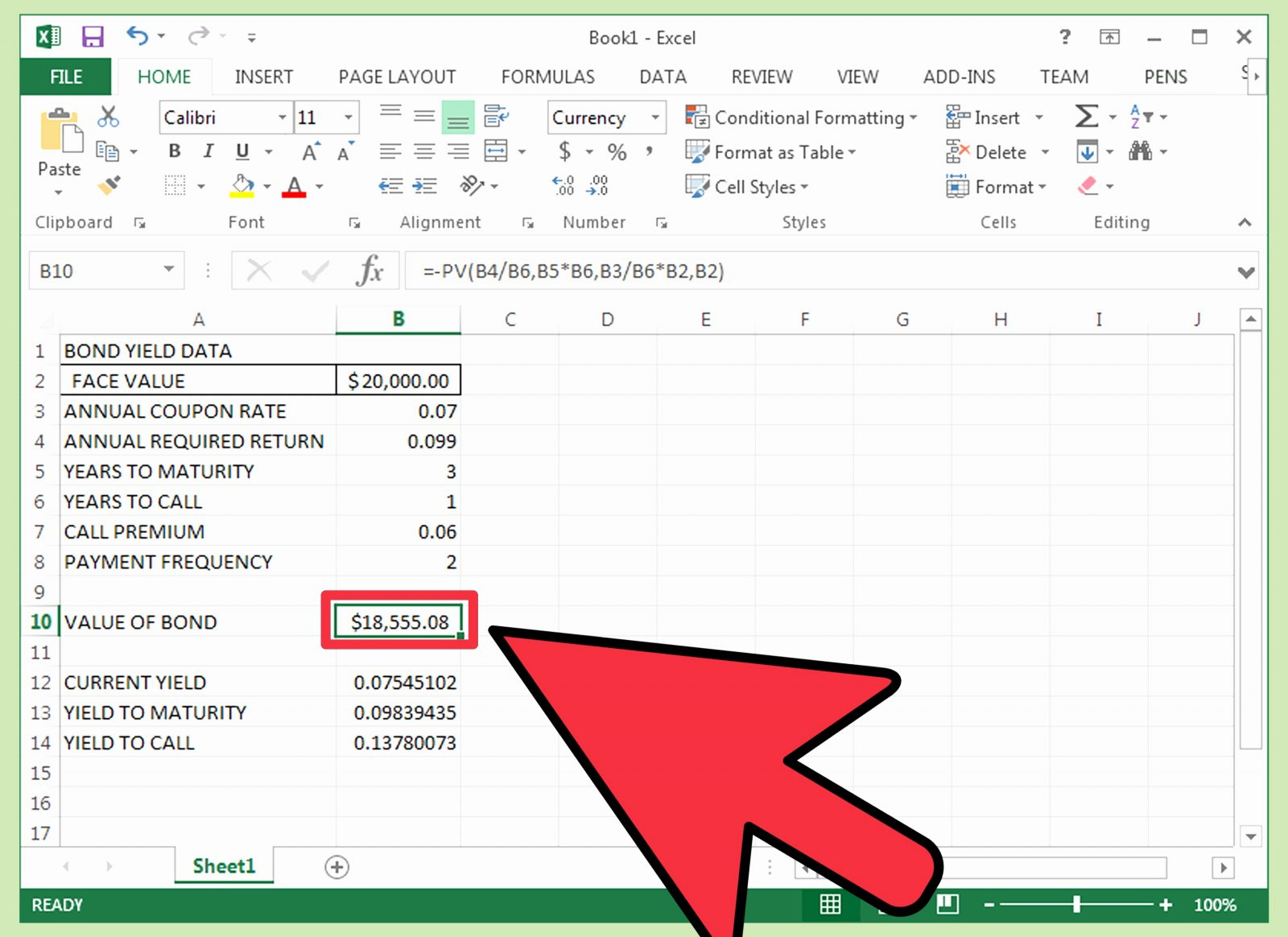

Coupon Bond Formula | Examples with Excel Template Coupon Bond Formula - Example #1. Let us take the example of some coupon paying bonds issued by DAC Ltd. One year back, the company had raised $50,000 by issuing 50,000 bonds worth $1,000 each. The bonds offer coupon rate of 5% to be paid annually and the bonds have a maturity of 10 years i.e. 9 years until maturity.

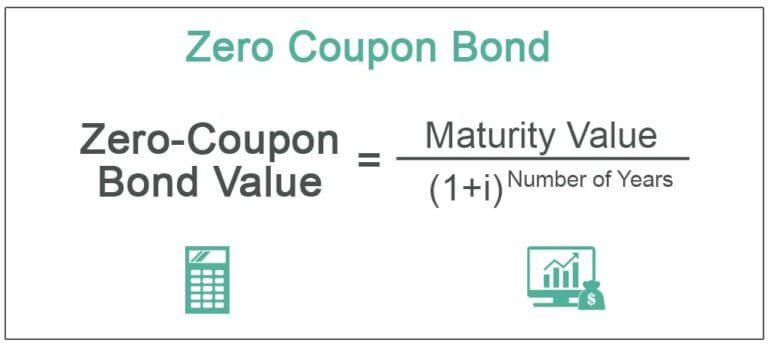

Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value.

What is a Coupon Rate? | Bond Investing | Investment U Coupon rates play a significant role in dictating demand for certain bonds. They come fixed at the time of issuance, while interest rates change. This means the two work in tandem to drive bond prices—and thus, demand for bonds. If the rate is higher than the current interest rate, bonds will trade at a premium.

Zero Coupon Bond | Investor.gov Glossary Zero Coupon Bond Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

What Is a Zero-Coupon Bond? | The Motley Fool Zero-coupon bonds are debt securities that are sold at deep discounts to face value. As their name indicates, they don't pay periodic interest payments, but they do reach full maturity at a certain...

6 What is the coupon rate for a $1,000 par value bond | Chegg.com 6 What is the coupon rate for a $1,000 par value bond with 7 years until maturity, a price of $902.63, and a yield to maturity of 10% ? (assume the coupon is paid annually). Fill in your answer here Help; Question: 6 What is the coupon rate for a $1,000 par value bond with 7 years until maturity, a price of $902.63, and a yield to maturity of ...

What Is a Zero-Coupon Bond? Definition, Characteristics & Example Typically, bond issuers (governments and corporations) reward bondholders (investors) with interest payments called "coupons" over the course of a bond's term before returning the principal amount,...

Guide, Examples, How Coupon Bonds Work Upon the issuance of the bond, a coupon rate on the bond’s face value is specified. The issuer of the bond agrees to make annual or semi-annual interest paymentsequal to the coupon rate to investors. These payments are made until the bond’s maturity. Let’s imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual c...

How to calculate bond price in Excel? - ExtendOffice You can calculate the price of this zero coupon bond as follows: Select the cell you will place the calculated result at, type the formula =PV(B4,B3,0,B2) into it, and press the Enter key. See screenshot: Note: In above formula, B4 is the interest rate, B3 is the maturity year, 0 means no coupon, B2 is the face value, and you can change them as you need. Calculate price of an …

Coupon Definition - Investopedia Apr 02, 2020 · A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms...

What Is a Bond Coupon? - The Balance Investors who bought bonds were given physical, engraved certificates before computers simplified much of the financial world. These certificates served as proof that you'd lent money to a bond issuer. You were entitled to receive the principal plus interest. Attached to each engraved bond was a series of bond coupons. Each coupon had a date on it....

Russia Pays Coupons in Rubles With Possible Default Looming Those funds -- about $100 million of bond coupons -- are stuck due to international sanctions, and the grace period to find a solution expires at the end of the day on June 26. At that point ...

Coupon Bond - Investopedia Mar 31, 2020 · A coupon bond, also referred to as a bearer bond or bond coupon, is a debt obligation with coupons attached that represent semiannual interest payments. With coupon bonds, there are no records of...

Post a Comment for "43 what is coupon for bond"