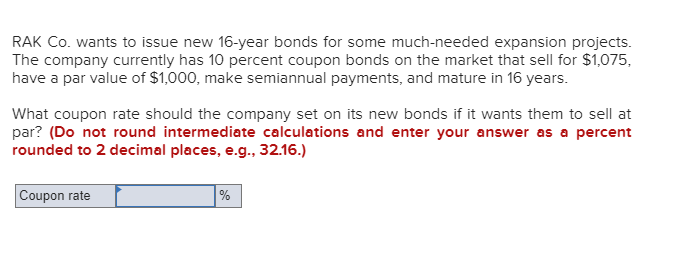

42 what coupon rate should the company set on its new bonds if it wants them to sell at par

Business Finance Ch6 Quiz - Connect Flashcards | Quizlet Business Finance Ch6 Quiz - Connect. Union Local School District has bonds outstanding with a coupon rate of 3.3 percent paid semiannually and 20 years to maturity. The yield to maturity on these bonds is 3.7 percent and the bonds have a par value of $10,000. What is the price of the bonds? Seether co wants to issue new 20 year bonds for some - Course Hero Seether Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 8 percent coupon bonds on the market that sell for $930, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? →8.75%.

BDJ Co. - Coupon Rate Bonds - brainmass.com BDJ Co. wants to issue new 10-year bonds for some much-needed expansion projects. The company currently has 8 percent coupon bonds on the market that sell for $1,095, make semiannual payments, and mature in 10 years. What coupon rate should the company set on its new bonds if it wants them to sell at par?

What coupon rate should the company set on its new bonds if it wants them to sell at par

Co. wants to issue new 19- year bonds for some necessary expansion Co. wants to issue new 19- year bonds for some necessary expansion. projects. the company currently has 8.2% coupon on the market that sell at 1148.09, make semiannual payments, and mature in 19 years. what coupon rate should the company set on its new bonds if it wants them to sell at par? Assume a par value of $1000. Answered: Chamberlain Co. wants to issue new… | bartleby A: Issue price = $ 960 Flotation cost = $ 35 Tax rate = 22% Par value = $ 1000 Coupon rate = 14% Coupon… Q: Crane, Inc., has four-year bonds outstanding that pay a coupon rate of 7.00 percent and make coupon… Solved Uliana Company wants to issue new 18-year bonds for | Chegg.com The company currently has 9 percent coupon bonds on the market that sell for $1,045, have a par value of $1,000, make semiannual payments, and mature in 18 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? Question: Uliana Company wants to issue new 18-year bonds for some much-needed expansion ...

What coupon rate should the company set on its new bonds if it wants them to sell at par. Finance Midterm 1 Flashcards - Quizlet LKM, Inc. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 6.5 percent coupon bonds on the market that sell for $972.78, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? RAK Co. wants to issue new 20-year bonds for some much ... - Brainly.com Click here 👆 to get an answer to your question ️ RAK Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 5… rainbow6241 rainbow6241 03/08/2021 Business College ... Coupon rate set on new bonds = Rate(40, 28.5, -1048, 1000) * 2. Ashok Co. wants to issue new 19-year bonds for some necessary expansion ... The coupon rate would be is = 6.8%. How to Financial calculator? For a bond to sell at par value, it means that the price is $1000 which is the same as the Face value, and also the YTM will be equal to the coupon rate. Then we are Using a financial calculator, then we input the following; After that, The Future value; FV is = 1000. Then Price ... OneClass: Chamberlain Co. wants to issue new 20-year bonds for some ... Seether Co. wants to issue new 13-year bonds for some much-needed expansion projects. The company currently has 9.8 percent coupon bonds on the market that sell for $868.69, make semiannual payments, and mature in 13 years. What coupon rate should the company set on its new bonds if it wants them to sell at par

7.6-7.7 Bonds: Inflation, Interest Rates,and Determinants of ... - Quizlet The company currently has 11.6 percent coupon semiannual payments, and mature in 14 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? Will be on exam. If Connor Co. wants the bonds to sell at par, they should set the coupon rate equal to the required return. Coupon Rate the Company Should Set on Its New Bonds A company currently has 10 percent coupon bonds on the market that sell for 1,063, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at. Answered: 22. Bond Yields [LO2] Chamberlain Co.… | bartleby Transcribed Image Text: 22. Bond Yields [LO2] Chamberlain Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 6 percent coupon bonds on the market that sell for $1,083, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them ... Solved Uliana Company wants to issue new 15-year bonds for | Chegg.com What coupon rate should the company set on its new bonds if it wants them to sell at par? (Do not round intermediate calculations and; Question: Uliana Company wants to issue new 15-year bonds for some much-needed expansion projects. The company currently has 9 percent coupon bonds on the market that sell for $1,070, make semiannual payments ...

Uliana Co. wants to issue new 20-year bonds for some much needed Need more help! Uliana Co. wants to issue new 20-year bonds for some much needed expansion projects. The company currently has 6 percent coupon bonds on the market with a par value of $1,000 that sell for $967, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? Pembroke co wants to issue new 20 year bonds for some The company should set the coupon rate on its new bonds equal to the required return; the required return can be observed in the market by finding the YTM on outstanding bonds of the company. Enter 40 $35 $1,000 N I/Y PV PMT FV Solve for 3.218% 3.218% × 2 = 6.44% Assignment Print View Bond Yields: Uliana Co. wants to issue new 20-year bonds ... - Brainly.com Bond Yields: Uliana Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 6% coupon bonds on the market with a par value of $1,000 that sell for $967, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond ...

Answer in Finance for rim #9185 - Assignment Expert LKM, Inc. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 6.5 percent coupon bonds on the market that sell for $972.78, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? 6.25 percent 6.37 percent 6.50 percent

7.3.docx - 1. Coccia Co. wants to issue new 20-year bonds ... - Course Hero Coccia Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 8 percent coupon bonds on the market that sell for $1,075, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? (Round your answer to 2 decimal places.

TBUS350 BUSINESS FINANCE CH 6 Flashcards - Quizlet Interest Rate Risk: Bond J has a coupon rate of 4%. Bond S has a coupon rate of 14%. Both bonds have 10 yrs to maturity, make semi-annual payments, and have a YTM of 8%. ... Company A has 8 percent coupon bonds on the market with 14 years left to maturity. The bonds make annual payments. ... XKL Co.has 9.2 percent semiannual-pay coupon bonds ...

Business Finance Test 2 Flashcards - Quizlet The bonds make semiannual payments and currently sell for 108.75 percent of par. ... What coupon rate should the company set on its new bonds if it wants them to sell at par? Coupon rate 8.40%. and mature in 11.5 years. What is the current price of these bonds if the yield to maturity is 6.36 percent? ... Alpha Supply issued 15-year bonds at ...

Post a Comment for "42 what coupon rate should the company set on its new bonds if it wants them to sell at par"