42 present value formula coupon bond

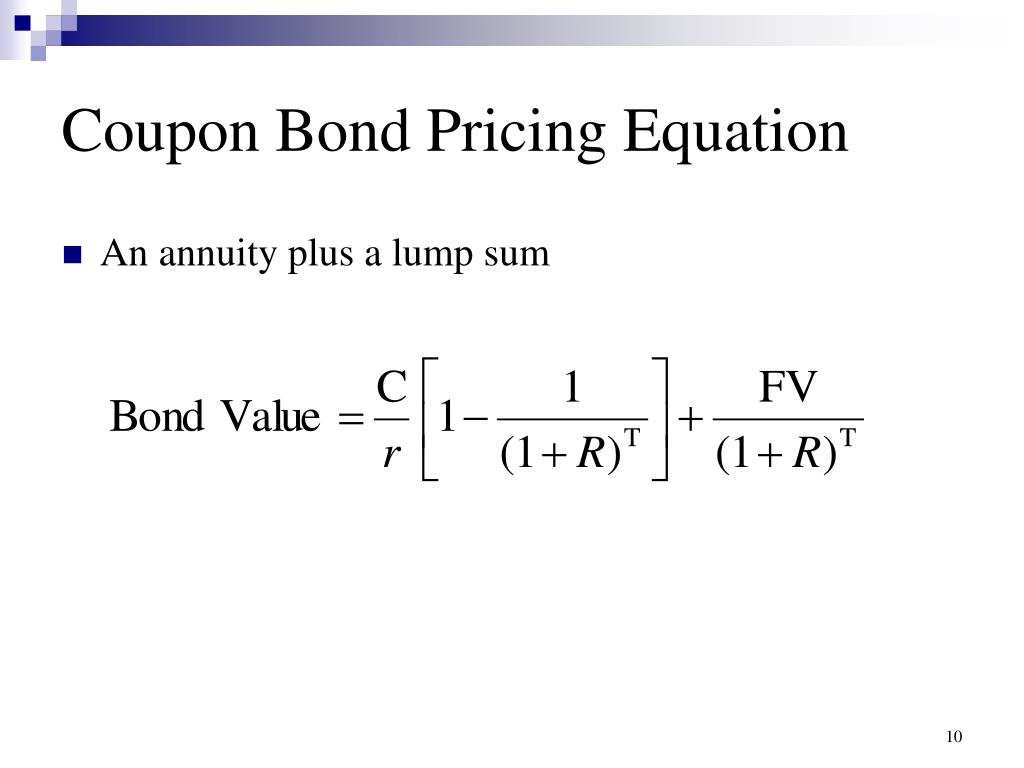

Bond Formulas - thismatter.com The most common bond formulas, including time value of money and annuities, bond yields, yield to maturity, and duration and convexity. ... Bond Value = Present Value of Coupon Payments + Present Value of Par Value. Duration Approximation Formula; Duration = P-- P + 2 × P 0 (Δy) P 0 = Bond price. Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

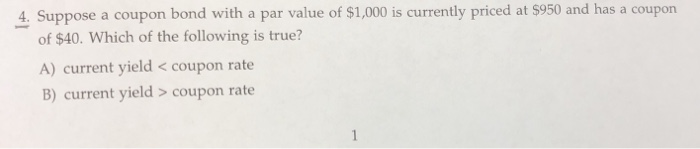

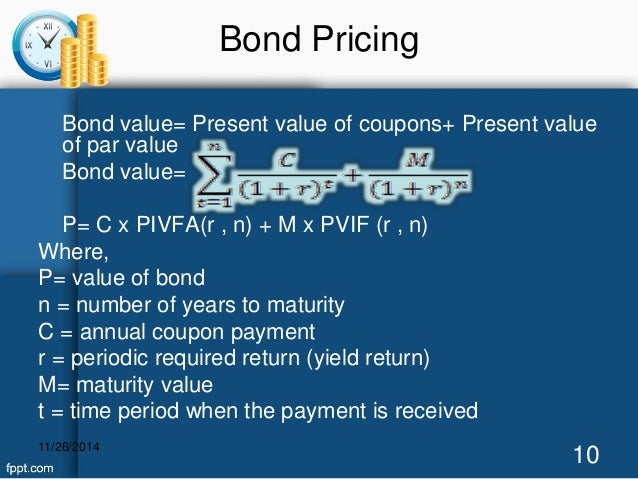

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? The present value is computed by discounting the cash flow using yield to maturity. Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n]

Present value formula coupon bond

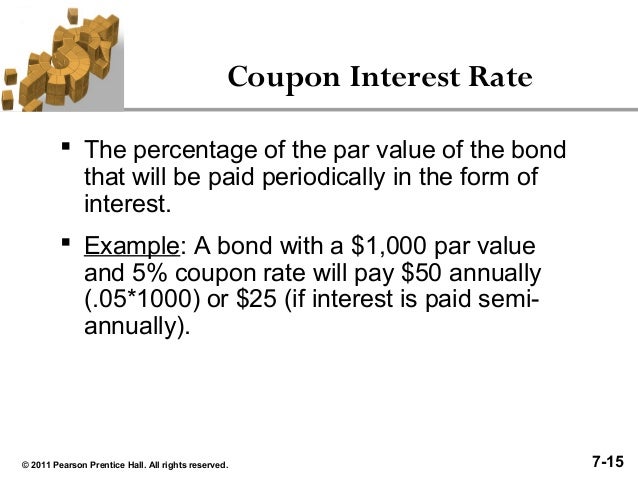

How to Calculate Present Value of a Bond - Pediaa.Com Present value of the interest payments can be calculated using following formula where, C = Coupon rate of the bond F = Face value of the bond R = Market t = Number of time periods occurring until the maturity of the bond Step 2: Calculate Present Value of the Face Value of the Bond How to Calculate PV of a Different Bond Type With Excel - Investopedia The bond has a present value of $376.89. B. Bonds with Annuities Company 1 issues a bond with a principal of $1,000, an interest rate of 2.5% annually with maturity in 20 years and a discount rate... Bond Pricing Formula | How to Calculate Bond Price? | Examples Bond Price = ∑i=1n C/ (1+r)n + F/ (1+r)n or Bond Price = C* (1- (1+r)-n/r ) + F/ (1+r)n You are free to use this image on your website, templates etc, Please provide us with an attribution link where C = Periodic coupon payment, F = Face / Par value of bond, r = Yield to maturity (YTM) and n = No. of periods till maturity

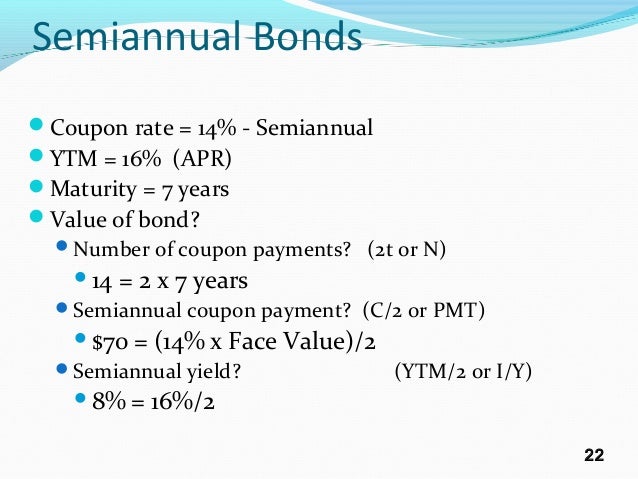

Present value formula coupon bond. Bond Formula | How to Calculate a Bond | Examples with Excel Template PV of kth Periodic Coupon Payment = (C / n) / (1 + r / n) k PV of Face Value = F / (1 + r / n) n*t Step 7: Finally, the bond formula can be derived by adding up the PV of all the coupon payments and the face value at maturity as shown below. Bond Price = C * [ (1 - (1 + r / n )-n*t ) / (r/n) ] + [F / (1 + r / n) n*t] Bond Present Value Calculator The calculator, uses the following formulas to compute the present value of a bond: Present Value Paid at Maturity = Face Value / (Market Rate/ 100) ^ Number Payments Present Value of Interest Payments = Payment Value * (1 - (Market Rate / 100) ^ -Number Payments) / Number Payments) Zero-Coupon Bond: Formula and Excel Calculator - Wall Street Prep If we input the provided figures into the present value (PV) formula, we get the following: Present Value (PV) = $1,000 / (1 + 3.0% / 2) ^ (10 * 2) PV = $742.47. The price of this zero-coupon is $742.47, which is the estimated maximum amount that you can pay for the bond and still meet your required rate of return. Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. ... Similar to the pricing of other types of bonds, the price of a coupon bond is determined by the present value formula. The formula is: Where: c = Coupon rate.

Bond Price Calculator | Formula | Chart It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A ... Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond is calculated using the Formula given below Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] Coupon Bond = $25 * [1 - (1 + 4.5%/2) -16] + [$1000 / (1 + 4.5%/2) 16 Coupon Bond = $1,033 Bond Valuation Definition - Investopedia Present value of semi-annual payments = 25 / (1.015) 1 + 25 / (1.015) 2 + 25 / (1.015) 3 + 25 / (1.015) 4 = 96.36 Present value of face value = 1000 / (1.015) 4 = 942.18 Therefore, the value of the... Annuity: Excel Calculator and Present Value (PV) Formula - Wall Street Prep Present Value (PV) of Annuity Bond Formula. PV = Σ A / (1 + r) ^ t. Where: PV = Present Value. A = Annuity Payment Per Period ($) t = Number of Periods. r = Yield to Maturity (YTM) Alternatively, a simpler approach consists of two steps: First, the annuity payment is divided by the yield to maturity (YTM), denoted as "r" in the formula.

Excel formula: Bond valuation example | Exceljet In the example shown, we have a 3-year bond with a face value of $1,000. The coupon rate is 7% so the bond will pay 7% of the $1,000 face value in interest every year, or $70. However, because interest is paid semiannually in two equal payments, there will be 6 coupon payments of $35 each. The $1,000 will be returned at maturity. How to calculate the present value of a bond — AccountingTools Go to a present value of $1 table and locate the present value of the bond's face amount. In this case, the present value factor for something payable in five years at a 6% interest rate is 0.7473. Therefore, the present value of the face value of the bond is $74,730, which is calculated as $100,000 multiplied by the 0.7473 present value factor. Bond Pricing Formula | How to Calculate Bond Price? | Examples Bond Price = ∑i=1n C/ (1+r)n + F/ (1+r)n or Bond Price = C* (1- (1+r)-n/r ) + F/ (1+r)n You are free to use this image on your website, templates etc, Please provide us with an attribution link where C = Periodic coupon payment, F = Face / Par value of bond, r = Yield to maturity (YTM) and n = No. of periods till maturity How to Calculate PV of a Different Bond Type With Excel - Investopedia The bond has a present value of $376.89. B. Bonds with Annuities Company 1 issues a bond with a principal of $1,000, an interest rate of 2.5% annually with maturity in 20 years and a discount rate...

How to Calculate Present Value of a Bond - Pediaa.Com Present value of the interest payments can be calculated using following formula where, C = Coupon rate of the bond F = Face value of the bond R = Market t = Number of time periods occurring until the maturity of the bond Step 2: Calculate Present Value of the Face Value of the Bond

Post a Comment for "42 present value formula coupon bond"