40 how to determine coupon rate

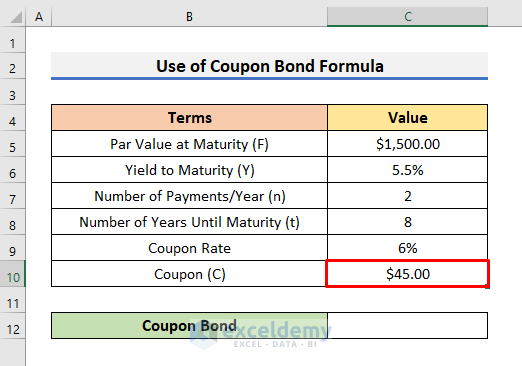

How to Calculate Coupon Rate in Excel (3 Ideal Examples) 2. Calculate Coupon Rate with Monthly Interest in Excel. In the following example, we will calculate the coupon rate with monthly interest in Excel. This is pretty much the same as the previous example but with a basic change. Monthly interest means you need to pay the interest amount each month in a year. So, the number of payments becomes 12 ... Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below, Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100, For Secured NCDs, Coupon Rate = (89 / 1000) * 100, Coupon Rate= 8.9%, For Unsecured NCDs, Coupon Rate = (91 / 1000) * 100, Coupon Rate= 9.1%,

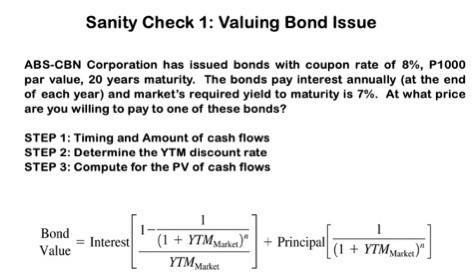

Coupon Rate Formula & Calculation - Study.com To calculate the coupon rate of ABZ, the steps discussed in the coupon rate formula should be followed. Identify the par value of the bond: In this example, ABZ is issuing bonds with a $1,000 par ...

How to determine coupon rate

Zero Coupon Bond Calculator - Nerd Counter The upper mentioned $323.01 is the actual cost of the 10 years' maturity coupon with a 20% interest rate and $2000 face rate. There is another zero-coupon bond example if the face value is $4000 and the interest rate is 30%, and we are going to calculate the price of a zero-coupon bond that matures in 20 years. How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow If you know the face value of the bond and its coupon rate, you can calculate the annual coupon payment by multiplying the coupon rate times the bond's face value. For example, if the coupon rate is 8% and the bond's face value is $1,000, then the annual coupon payment is .08 * 1000 or $80. [6] 2, Coupon Rate - Meaning, Calculation and Importance - Scripbox To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100, Coupon Rate = 100 / 500 * 100 = 20%, Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds, Bonds pay interest to their holders.

How to determine coupon rate. What Is Coupon Rate and How Do You Calculate It? - Accounting Services Coupon rate is calculated by adding up the total amount of annual payments made by a bond, then dividing that by the face value (or "par value") of the bond. For example: ABC Corporation releases a bond worth $1,000 at issue. Every six months it pays the holder $50. Coupon Rate Formula | Simple-Accounting.org A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value.As a simple example, consider a zero coupon bond with a face, or par, value of $1200, and a maturity of one year. What is 'Coupon Rate' - The Economic Times Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 ... US Prime Rates from 1955 to September 2022 | Casaplorer Banks use this Fed Funds Rate as a starting point to determine the Prime Lending Rate for their most creditworthy customers. In most cases, the prime rate is 3% or 300 bps above the Fed Funds Rate. For example, if the Fed Funds Rate = 0.5%, the US Prime Interest Rate would equal 0.5% + 3% = 3.5% on average.

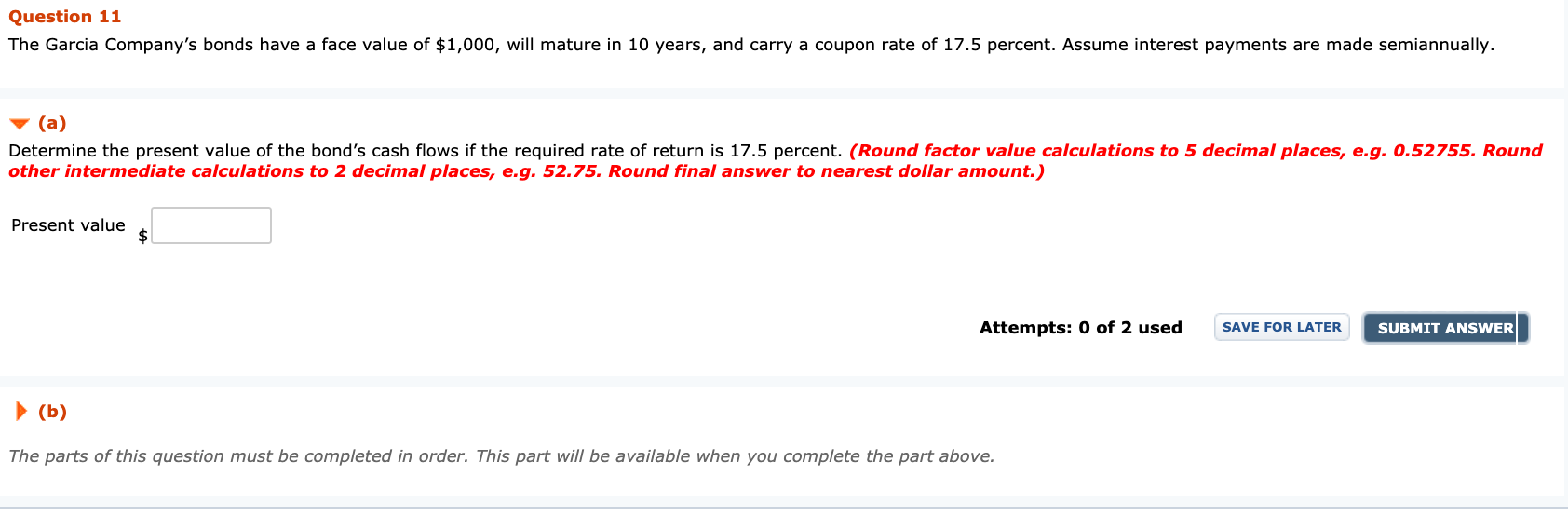

Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security. Postal Rate Change FAQs | Quadient Each of our rate change telephone agents is specially trained to assist you. You may also contact a Service and Repair team technician for live assistance by selecting the Repair menu prompt offered on 1 800 636 7678. Repair representatives are available Monday through Friday between 7 a.m. and 6 p.m. Central Time. ... How can I determine if I ... Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100%, You are free to use this image on your website, templates, etc, Please provide us with an attribution link, Coupon Rate and Yield to Maturity | How to Calculate Coupon Rate The coupon rate represents the actual amount of interest earned by the bondholder annually while the yield to maturity is the estimated total rate of return ...

What Is Coupon Rate and How Do You Calculate It? A bond's coupon price could be calculated by dividing the sum of the safety's annual coupon payments and dividing them by the bond's par worth. For instance, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%. Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Online coupon rate calculation. Use this simple finance coupon rate calculator to calculate coupon rate. Excel Discount Rate Formula: Calculation and Examples - Investopedia 20/05/2022 · The discount rate is the interest rate used to calculate net present value. It represents the time value of money. Net present value can help companies to determine whether a proposed project may ... 2022 UPS Rate & Service Guide Determine the service that best meets your needs for domestic, export and import shipping. Also, learn about certain service restrictions that may apply. Section 2 PREPARING A SHIPMENT PAGES 10-26 Information about how you package a shipment, determine the rate and get the shipment to UPS is provided. Section 3 DETERMINING THE RATE PAGES 27-141

Delivery Service Area Maps | Spee-Dee Delivery To find your exact location, use our shipping rate calculator. The Zip Transit File is used to determine transit times for all zip codes in the Spee-Dee service area. Download Zip Transit File (XLSX) Service Area Maps Download ; Spee-Dee Delivery Service, Inc.

5.56 Twist Rate Chart & Recommendations - AmmoForSale.com 16/02/2022 · We even include a 5.56 twist rate chart that’ll help you determine the likely best ammo to use with your AR-15. A rifled barrel works simply enough: Spiraling grooves and lands on the bore force the bullet to rotate as it passes through the barrel. The bullet continues rotating once it has exited the muzzle, which grants it the gyroscopic ...

What is a Coupon Rate? - Definition | Meaning | Example In order to calculate the coupon rate formula of a bond, we need to know: the face value of the bond, the annual coupon rate, and the number of periods per annum. Let's look at an example. Example. The coupon payment on each bond is $1,000 x 8% = $80. So, Georgia will receive $80 interest payment as a bondholder.

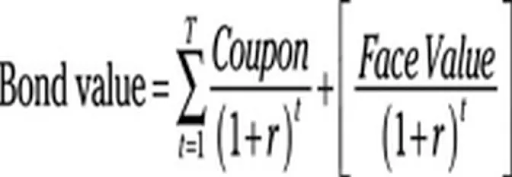

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The issuer makes periodic interest payments until maturity when the bondholder's initial investment - the face value (or "par value") of the bond - is returned to the bondholder. Formula for Calculating the Coupon Rate, Where: C = Coupon rate, i = Annualized interest, P = Par value, or principal amount, of the bond, Download the Free Template,

2021 UPS Rate & Service Guide 11/07/2021 · Determine the service that best meets your needs for domestic, export and import shipping. Also, learn about certain service restrictions that may apply. Section 2 PREPARING A SHIPMENT PAGES 10-24 Information about how you package a shipment, determine the rate and get the shipment to UPS is provided. Section 3 DETERMINING THE RATE PAGES 25-138

What Is a Coupon Rate? And How Does It Affects the Price of a Bond ... Every year it pays the holder $50. To calculate the bond coupon rate, total annual payments need to be divided by the bond's par value. Annual payments = $ 50. Coupon rate = $500 / $1,000 = 0.05. The bond's coupon rate is 5 percent. This is the portion of bond that shall be paid every year.

How To Find Coupon Rate Of A Bond On Financial Calculator Once you have this information, you can follow these steps to calculate the coupon rate: 1) Enter the face value of the bond into the calculator. 2) Enter the coupon rate into the calculator. 3) Enter the number of years until the bond matures into the calculator. 4) Enter the market interest rate into the calculator.

Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate The steps to calculate the coupon rate of a bond are the following: Firstly, the face value or par value of the bond issuance is determined as per the funding requirement of the company. Now, the number of interest paid during the year is determined, and then the annualized interest payment is calculated by adding up all the payments during the ...

How to Calculate ROI from Coupons & Discounts? - Voucherify Just to remind you, Voucherify supports five types of discounts: Amount (e.g. $10 off), Percentage (e.g. 20% off), Unit (e.g. 2 free piano classes). Free shipping, Fixed amount, Once the coupon is created, the tracking becomes super simple. In this case, you just watch the number of redemptions.

How to calculate Discount Rate with Examples - EDUCBA Explanation. The formula for the discount rate can be derived by using the following steps: Step 1: Firstly, determine the value of the future cash flow under consideration. Step 2: Next, determine the present value of future cash flows. Step 3: Next, determine the number of years between the time of the future cash flow and the present day.

What Is a Coupon Rate? How To Calculate Them & What They're Used For Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same. For instance, say a bond has face value of $2000 and a coupon rate of 10%.

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision The coupon is calculated by multiplying the coupon rate by the par value (also known as face value) of the bond. The par value of a bond is the amount that the issuer agrees to repay to the bondholder at the time of maturity of the bond. In formula it can be written as follows: Coupon = Coupon Rate X Par Value,

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000...

Coupon Rate - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond, For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000, Coupon Rate = 6%, Annual Coupon = $100,000 x 6% = $6,000,

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for...

Coupon Rate Calculator | Bond Coupon 15/07/2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ...

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Discounting Formula | Steps to Calculate Discounted Value Coupon frequency= semi-annually; 1 st Settlement date=1 st Jan 2019; Coupon Rate=8.00%; Par Value=$1,000; The Spot rate in the market Spot Rate In The Market Spot Rate' is the cash rate at which an immediate transaction and/or settlement takes place between the buyer and seller parties. This rate can be considered for any and all types of ...

Coupon Rate - Meaning, Calculation and Importance - Scripbox To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100, Coupon Rate = 100 / 500 * 100 = 20%, Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds, Bonds pay interest to their holders.

How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow If you know the face value of the bond and its coupon rate, you can calculate the annual coupon payment by multiplying the coupon rate times the bond's face value. For example, if the coupon rate is 8% and the bond's face value is $1,000, then the annual coupon payment is .08 * 1000 or $80. [6] 2,

Zero Coupon Bond Calculator - Nerd Counter The upper mentioned $323.01 is the actual cost of the 10 years' maturity coupon with a 20% interest rate and $2000 face rate. There is another zero-coupon bond example if the face value is $4000 and the interest rate is 30%, and we are going to calculate the price of a zero-coupon bond that matures in 20 years.

:max_bytes(150000):strip_icc()/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

![Yield to Maturity (YTM): Formula and Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2022/01/19095826/Yield-to-Maturity-YTM-Formula.jpg)

![Zero-Coupon Bond: Formula and Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2022/01/28183250/Zero-Coupon-Bonds-Formula-960x325.jpg)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "40 how to determine coupon rate"