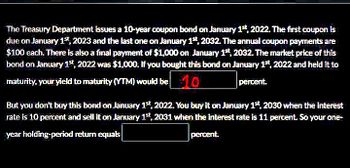

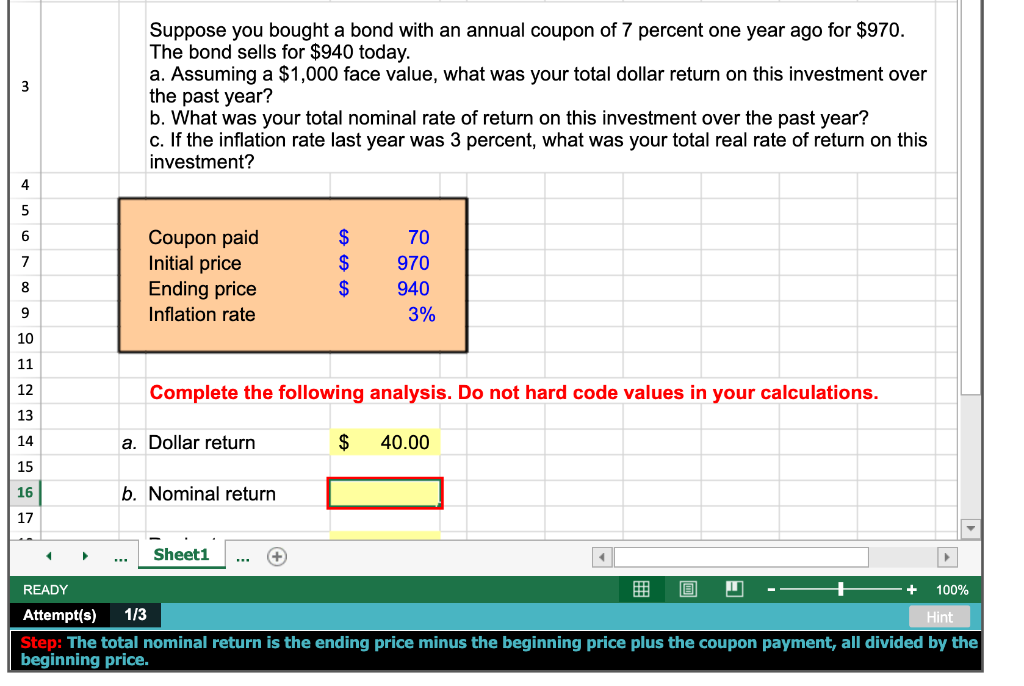

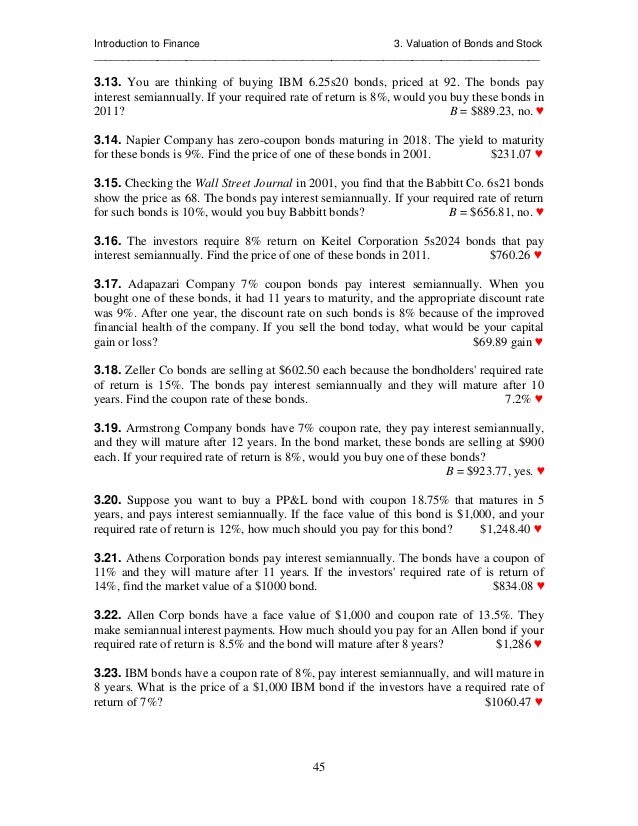

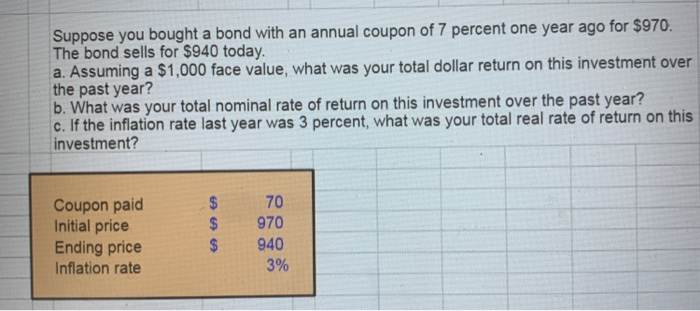

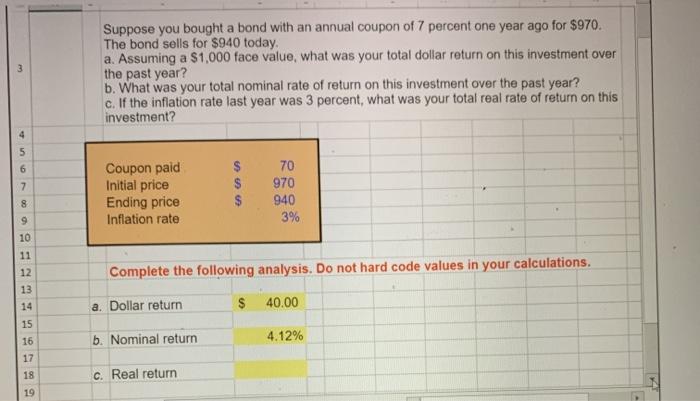

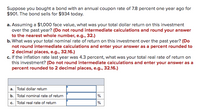

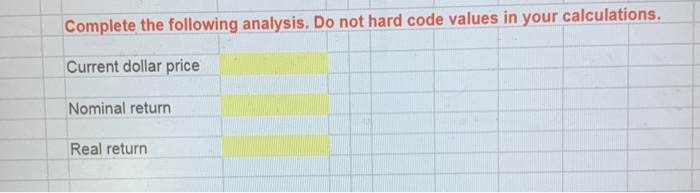

39 suppose you bought a bond with an annual coupon of 7 percent

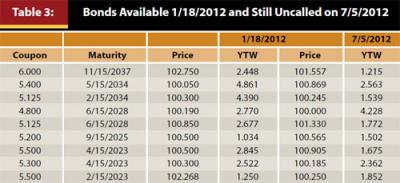

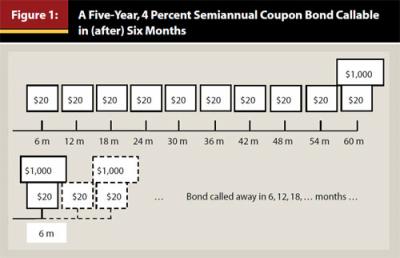

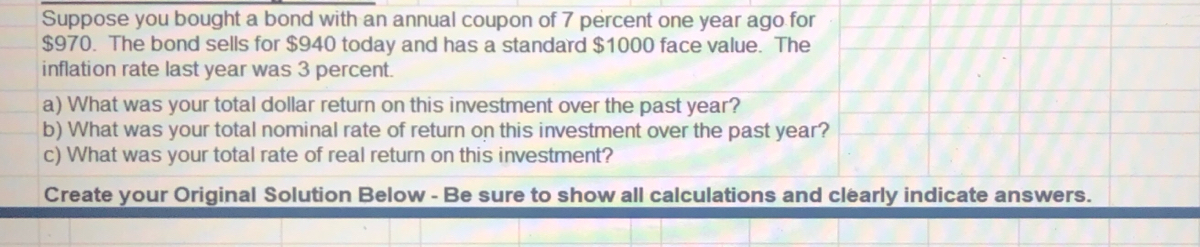

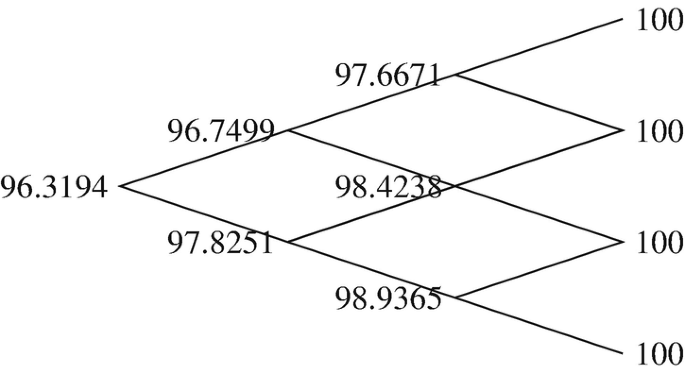

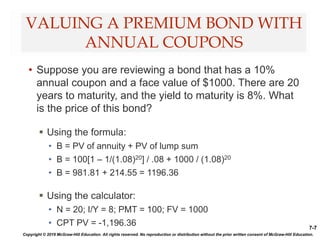

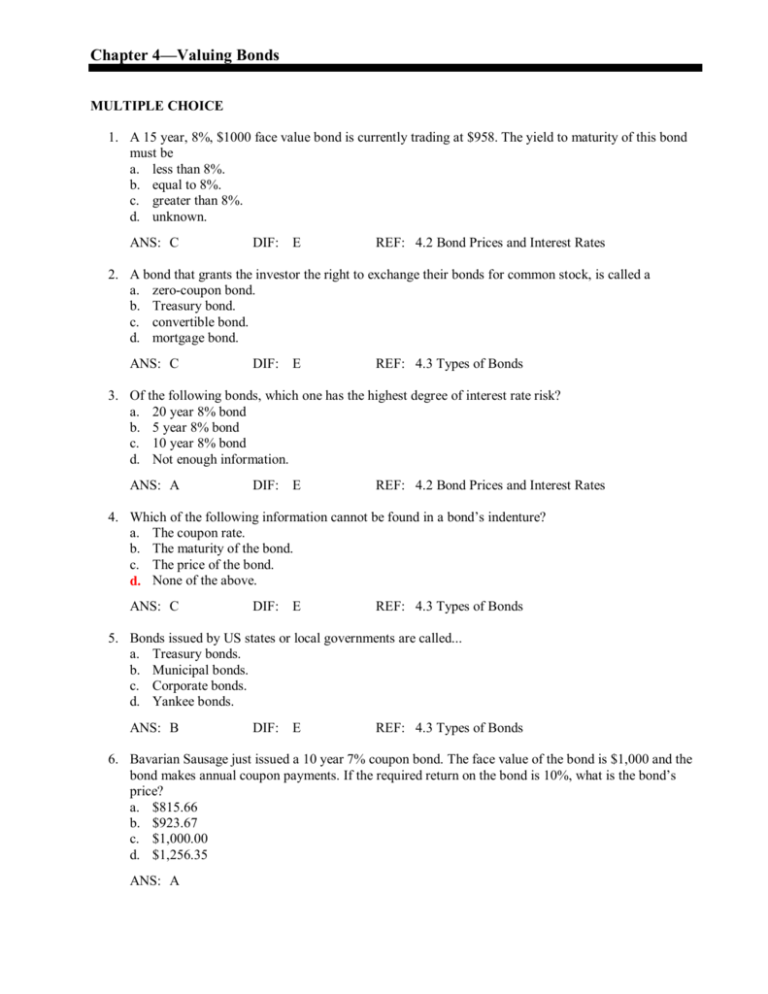

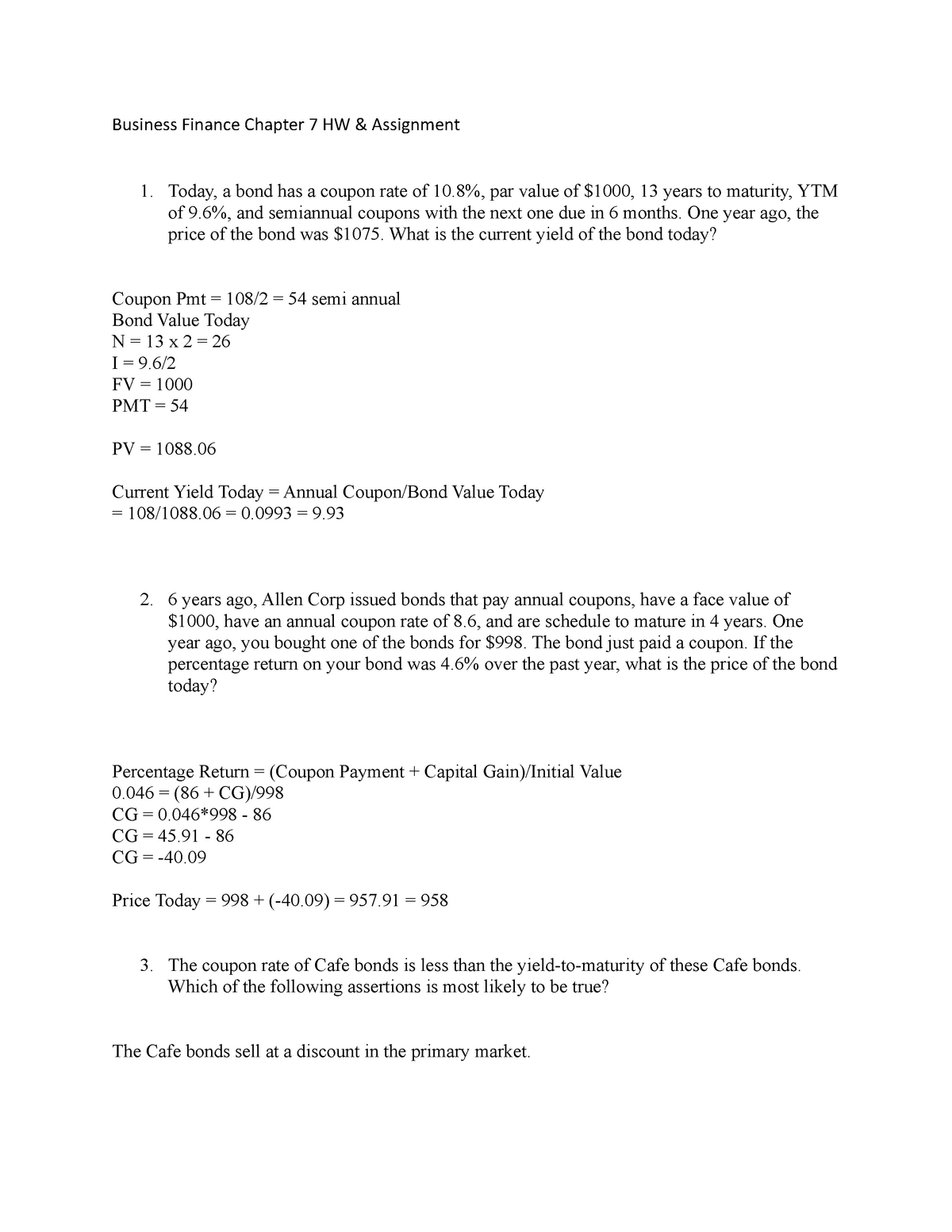

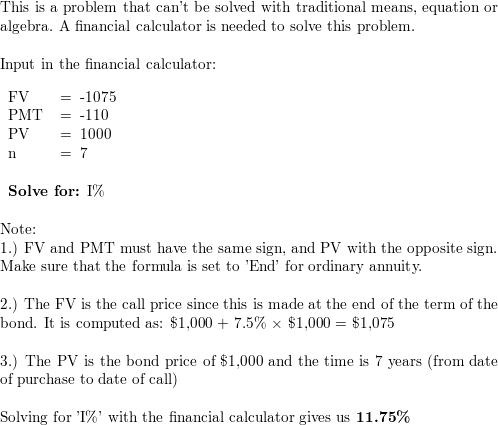

Answered: Suppose a 4-year, 3% annual coupon… | bartleby Suppose a 4-year, 3% annual coupon payment bond has the following sequence of spot rates: Time to maturity Spot rates 1 year 0.39% 2 years 1.40% 3 years 2.50% 4 years 3.60% Assume a par value of $100. What is the price of the bond? A. $102.67 B. $98.104 C. $96.86 Answered: How is the value of a bond determined?… | bartleby f. How does the calculation for valuing a bond change if semiannual payments are made? Find the value of a 10-year, semiannual payment, a 10 percent coupon bond if investor’s required rate of return is 13%. 1. What is the bond's yield to call (YTC)? 2. If you bought this bond, do you think you would be more likely to earn the YTM or the YTC? Why?

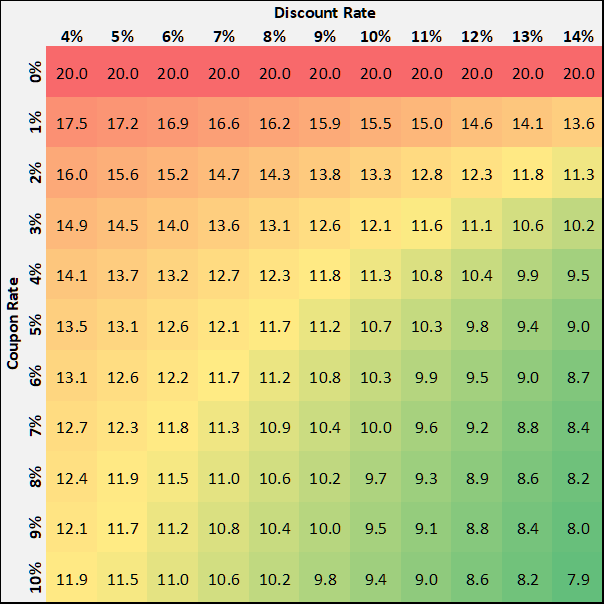

Bond duration: how it works and how you can use it - Monevator Oct 25, 2022 · The daily, monthly, and annual shifts in yield shows you the impact of recent changes in market interest rates for each UK government bond in the table. You can see, for instance, that the yield (note: not the price) on the UK’s benchmark ten-year gilt rose 1.4% in the last month. In the last year the yield is up 3.5%.

Suppose you bought a bond with an annual coupon of 7 percent

U.S. appeals court says CFPB funding is unconstitutional - Protocol Oct 20, 2022 · That means the impact could spread far beyond the agency’s payday lending rule. "The holding will call into question many other regulations that protect consumers with respect to credit cards, bank accounts, mortgage loans, debt collection, credit reports, and identity theft," tweeted Chris Peterson, a former enforcement attorney at the CFPB who is now a law professor at the University of Utah. PlayStation userbase "significantly larger" than Xbox even if every … Oct 12, 2022 · Get your first month for £1 (normally £3.99) when you buy a Standard Eurogamer subscription. Enjoy ad-free browsing, merch discounts, our monthly letter from the editor, and show your support ... How to Calculate Bond Total Return: 3 Ways to Assess the ... - wikiHow Nov 05, 2020 · In either case, you still receive interest payments based on the face value and coupon rate of the bond. The annual interest payments on the bond are $50,000 ($500,000 * .10 = $50,000). When a bond matures, you get the face value of the bond. Whether you bought the bond at a discount or a premium, upon maturity you receive the face value.

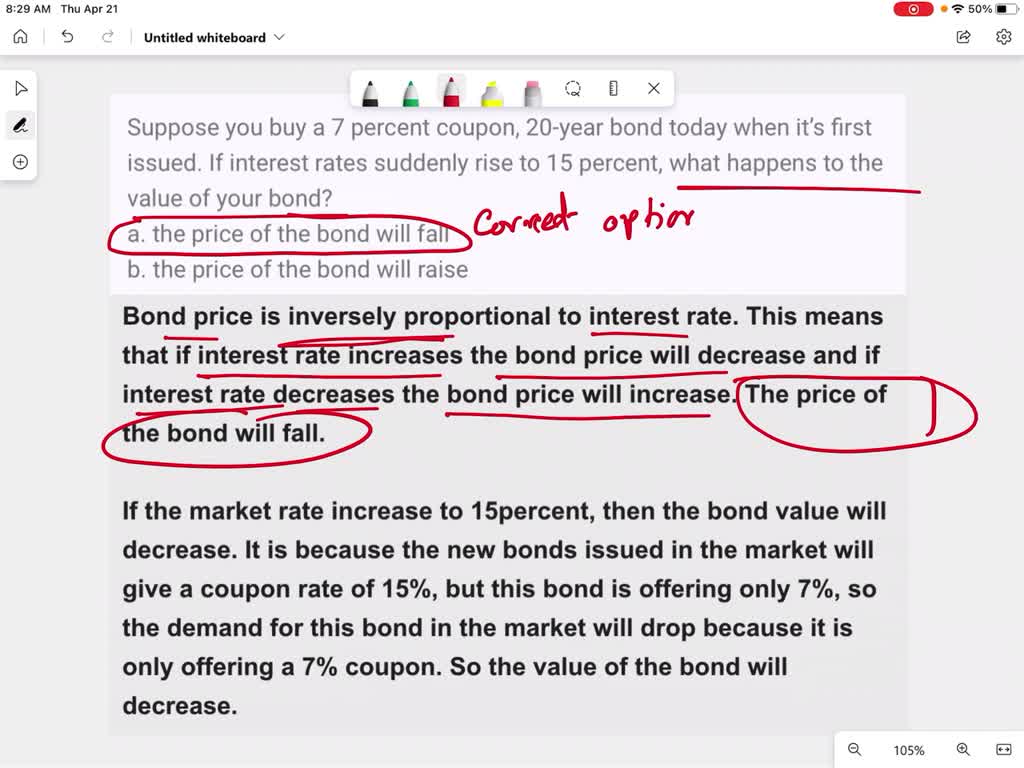

Suppose you bought a bond with an annual coupon of 7 percent. PPIC Statewide Survey: Californians and Their Government Oct 27, 2022 · Seventy-six percent rate the nation’s economy as “not so good” or “poor.” Thirty-nine percent say their finances are “worse off” today than a year ago. ... 7% don’t know Next, 30. Do you think things in the United States are generally going in the right direction or the wrong direction? 33% right direction 62% wrong direction 5% ... Ch3- Practice Questions Flashcards | Quizlet 32) Suppose you are holding a 5 percent coupon bond maturing in one year with a yield to maturity of 15 percent. If the interest rate on one-year bonds rises from 15 percent to 20 percent over the course of the year, what is the yearly return on the bond you are holding? A) 5 percent B) 10 percent C) 15 percent D) 20 percent Entertainment News |Latest Celebrity News, Videos & Photos - ABC News … Oct 14, 2022 · Get up to the minute entertainment news, celebrity interviews, celeb videos, photos, movies, TV, music news and pop culture on ABCNews.com. Microsoft is building an Xbox mobile gaming store to take on … Oct 19, 2022 · The $68.7 billion Activision Blizzard acquisition is key to Microsoft’s mobile gaming plans. ... (20 percent), PCs at $40 billion (24 percent), and mobile gaming at $85 billion ...

How to Calculate Bond Total Return: 3 Ways to Assess the ... - wikiHow Nov 05, 2020 · In either case, you still receive interest payments based on the face value and coupon rate of the bond. The annual interest payments on the bond are $50,000 ($500,000 * .10 = $50,000). When a bond matures, you get the face value of the bond. Whether you bought the bond at a discount or a premium, upon maturity you receive the face value. PlayStation userbase "significantly larger" than Xbox even if every … Oct 12, 2022 · Get your first month for £1 (normally £3.99) when you buy a Standard Eurogamer subscription. Enjoy ad-free browsing, merch discounts, our monthly letter from the editor, and show your support ... U.S. appeals court says CFPB funding is unconstitutional - Protocol Oct 20, 2022 · That means the impact could spread far beyond the agency’s payday lending rule. "The holding will call into question many other regulations that protect consumers with respect to credit cards, bank accounts, mortgage loans, debt collection, credit reports, and identity theft," tweeted Chris Peterson, a former enforcement attorney at the CFPB who is now a law professor at the University of Utah.

Post a Comment for "39 suppose you bought a bond with an annual coupon of 7 percent"