45 consider a bond paying a coupon rate of 10 per year semiannually when the market

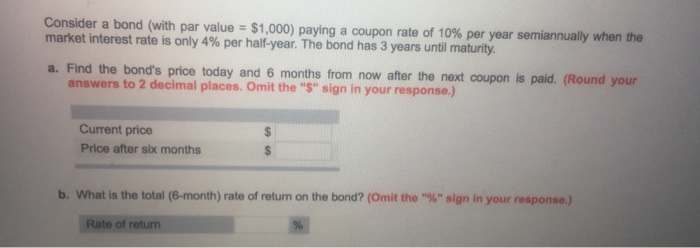

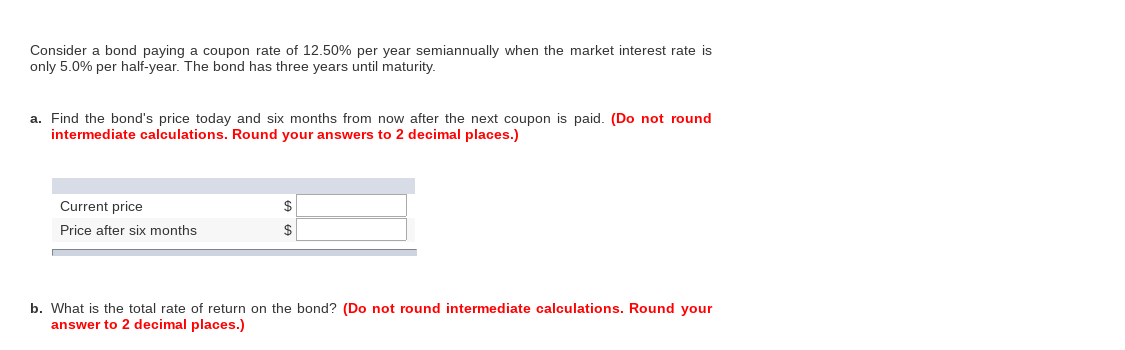

Answered: Consider a bond paying a coupon rate of… | bartleby Consider a bond paying a coupon rate of 10% per year semi-annually when the market interest rate is only 4% per half-year. The bond has three years until maturity. This initial payment is $1000. A: What is find the bond's price today and 6 months time after the next coupon is paid Question [Solved] Consider a bond paying a coupon rate of 1 | SolutionInn Consider a bond paying a coupon rate of 10% per. Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has 3 years until maturity. a. Find the bond's price today and 6 months from now after the next coupon is paid. b.

Answered: Consider a bond paying a coupon rate of… | bartleby Question Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. b. What is the total (6-month) rate of return on the bond? Expert Solution

Consider a bond paying a coupon rate of 10 per year semiannually when the market

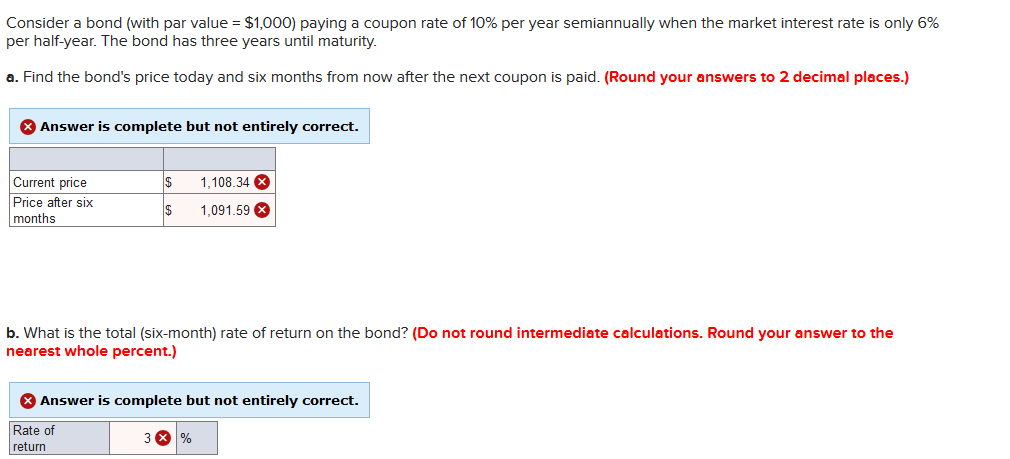

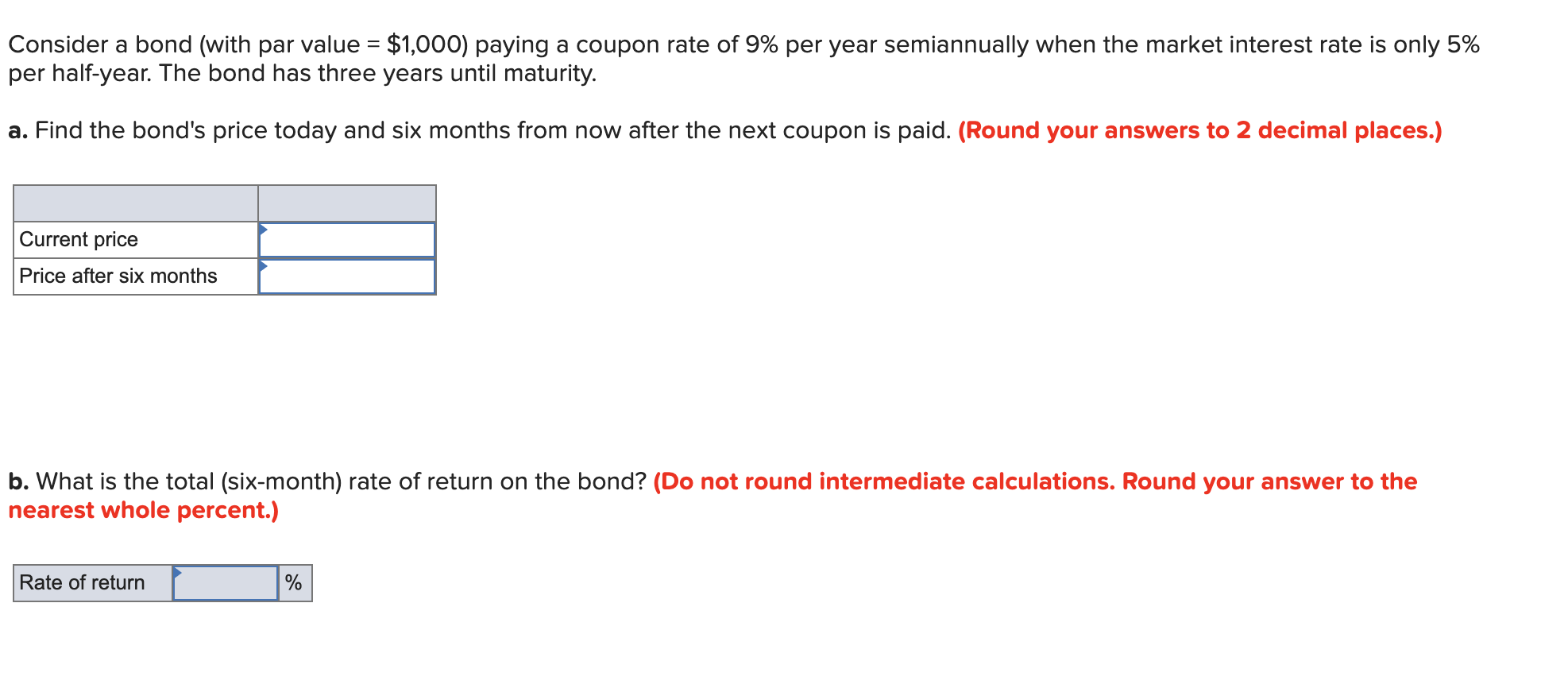

Solved Consider a bond (with par value = $1,000) paying a - Chegg Question: Consider a bond (with par value = $1,000) paying a coupon rate of 10% per year semiannually when the market interest rate is only 5% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Round your answers to 2 decimal places.) The Power of Compound Interest: Calculations and Examples 19.07.2022 · Compound interest (or compounding interest) is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan . Thought to have ... (Solved) - Consider a bond paying a coupon rate of 10% per year ... 1 Answer to Consider a ...

Consider a bond paying a coupon rate of 10 per year semiannually when the market. Solved Consider a bond paying a coupon rate of 10.50% per - Chegg Question: Consider a bond paying a coupon rate of 10.50% per year semiannually when the market interest rate is only 4.2% per half-year. The bond has two years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Consider a bond (with par value = $1,000) paying a coupon rate of 8% ... Consider a bond (with par value = $1,000) paying a coupon rate of 8% per year semiannually when the market interest rate is only 6% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Round your answers to 2 decimal places.) Advertisement quizlet.com › 538573382 › bus1-170-exam-2-flash-cardsBus1-170 Exam 2 Flashcards | Quizlet If the coupon interest rate is 4.375% for the first six months and changes to a rate equal to the 10-year Treasury bond rate plus 1.3% thereafter, the bond is called a floating-rate bond. floating-rate › securities › treasury-bondsTreasury Bonds | CBK If the bond has a pre-determined coupon rate in the prospectus, you should choose Non-Competitive/Average Rate. If the prospectus says that the coupon rate is market determined, you can select either the Interest/Competitive Rate or the Non-Competitive/Average Rate. Investors choosing the Interest/Competitive Rate bid on the bonds by submitting ...

Foundations of Finance - Class 8 and 9 - Quizlet Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has 3 years until maturity. a. Find the bond's price today and 6 months from now after the next coupon is paid. b. What is the total (6-month) rate of return on the bond? ... 16. Yield to Maturity and Default Risk - Rate Return - Do Financial Blog Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. ... Consider a five-year bond with a 10% coupon that has a present yield to maturity of 8%. If ... OneClass: Consider a bond paying a coupon rate of 10% per year ... Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Answered: Consider a bond paying a coupon rate of… | bartleby Business Finance Q&A Library Consider a bond paying a coupon rate of 10% per year semi-annually when the market interest rate is only 4% per half-year. The bond has three years until maturity. This initial payment is $1000. A: What is find the bond's price today and 6 months time after the next coupon is paid?

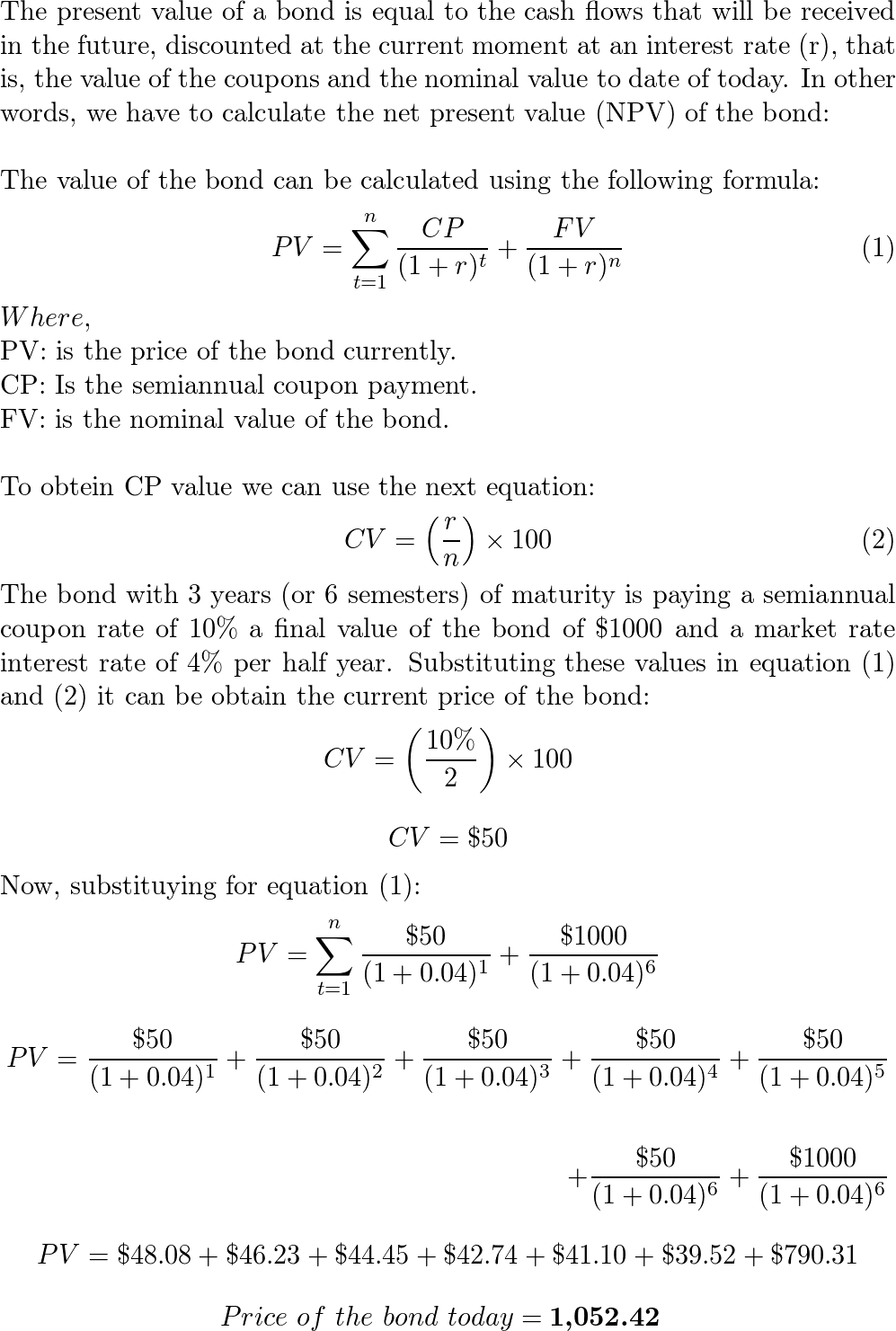

Consider a bond paying a coupon rate of 10% per year semiannually when ... Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4%. The bond has 3 years until maturity. a. Find the bond price today and six months from now after the next coupon is paid, assuming the market rate will be constant during the following 6 months. b. Consider a bond paying a coupon rate of 10 per year semiannually when ... The 3 year bond is paying a 10% coupon rate (semi-annually) that has a market rate interest rate of 4% per half year. a. Calculate the bond price. PMT = (10%/2 x 1,000) = 50 FV = 1,000 n = 3 years x 2 = 6 r = 4% PV = 1,052.42 Price of the bond six months from now can be calculated by assuming that market interest rate remains 4% per half year. Consider a bond paying a coupon rate of $10\%$ per year semi | Quizlet Consider a bond paying a coupon rate of 10\% 10% per year semiannually when the market interest rate is only 4\% 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. b. What is the total rate of return on the bond? Solution Verified Solved Consider a bond paying a coupon rate of 10% per - Chegg Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has 3 years until maturity. a. Find the bond's price today and 6 months from now after the next coupon is paid. b. What is the total (6 month) rate of return on the bond? Expert Answer

(Get Answer) - Consider a bond paying a coupon rate of 9.25% per year ... Consider a bond paying a coupon rate of 9.25% per year semiannually when the market interest rate... Consider a bond paying a coupon rate of 9.25% per year semiannually when the market interest rate is only 3.7% per half-year. The bond has five years until maturity a. Find the bond's price today and six months from now alter the next coupon is ...

Consider a bond paying a coupon rate of 10% per year semiann - Quizlet Expert solutions Question Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. Find the bond's price today and six months from now after the next coupon is paid. Solutions Verified Solution A Solution B Create an account to view solutions

Solved Consider a bond paying a coupon rate of 10% per year - Chegg Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. (LO 10 a. Find the bond's price today and six months from now after the next coupon is paid b. What is the total rate of return on the bond?

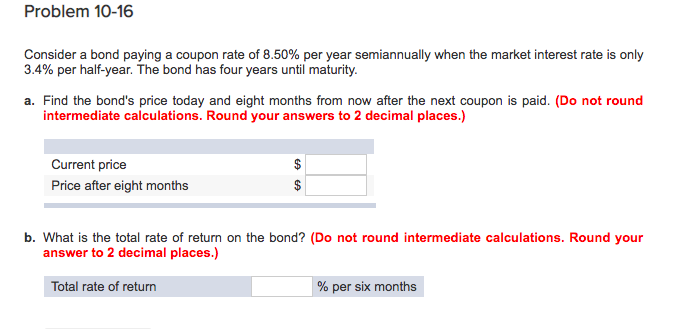

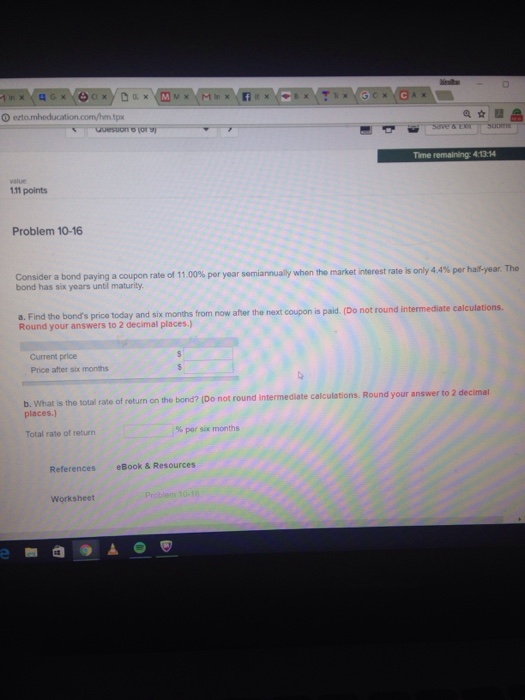

OneClass: Problem 10-16 Consider a bond paying a coupon rate of 8. Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Do not round intermediate calculations. Round your answers to 2 decimal places.)

Practice problems - Consider a bond paying a coupon rate of 10% per ... Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Do not round intermediate calculations. Round your answers to 2 decimal places.)

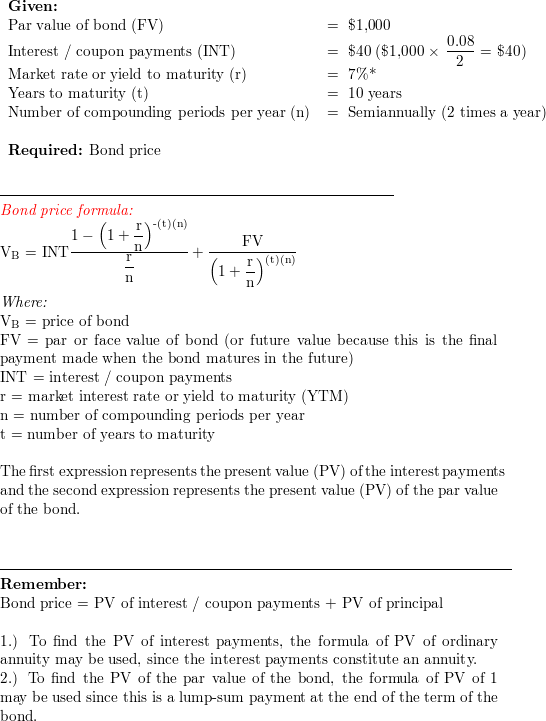

Investments Final Flashcards | Quizlet Consider a bond paying a coupon rate of 10% per year semi-annually when the market rate of interest is 8.5% per year. The bond has three years until maturity. Calculate the bond's price today. 1,000 FV, 50 PMT, 6 N, 4.25 I/Y CPT PV = 1,038.99805 Price = $1,039.00 YTM- Zero Coupon Bond

› etf-basics › how-do-bond-etfs-workHow Do Bond ETFs Work? | ETF.com A hypothetical $100 bond has a 5 percent coupon — meaning, every year, the bond will pay out $5 to investors until it matures. Then interest rates rise 2 percent. Then interest rates rise 2 percent.

Solved Consider a bond paying a coupon rate of 10% per - Chegg See the answer Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half year. The bond has three years until maturity. Find the bond's six months from now after the next coupon is paid. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Expert Answer

Fin 311 - ch. 10 homework - bond prices and yields - Quizlet 16 Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. find the bond's price today and six months from now after the next coupon is paid. b. what is the total rate of return on the bond? ...

Homework Help and Textbook Solutions | bartleby Hier sollte eine Beschreibung angezeigt werden, diese Seite lässt dies jedoch nicht zu.

[Solved] Consider a bond paying a coupon rate of 1 | SolutionInn Consider a bond paying a coupon rate of 12.25% per year semiannually when the market interest rate is only 4.9% per half-year. The bond has six years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Do not round intermediate calculations. Round your answers to 2 decimal places.) b.

Coupon Rate of a Bond - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

(Solved) - Consider a bond paying a coupon rate of 10% per year ... 1 Answer to Consider a ...

The Power of Compound Interest: Calculations and Examples 19.07.2022 · Compound interest (or compounding interest) is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan . Thought to have ...

Solved Consider a bond (with par value = $1,000) paying a - Chegg Question: Consider a bond (with par value = $1,000) paying a coupon rate of 10% per year semiannually when the market interest rate is only 5% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Round your answers to 2 decimal places.)

Post a Comment for "45 consider a bond paying a coupon rate of 10 per year semiannually when the market"