41 coupon rate and yield to maturity

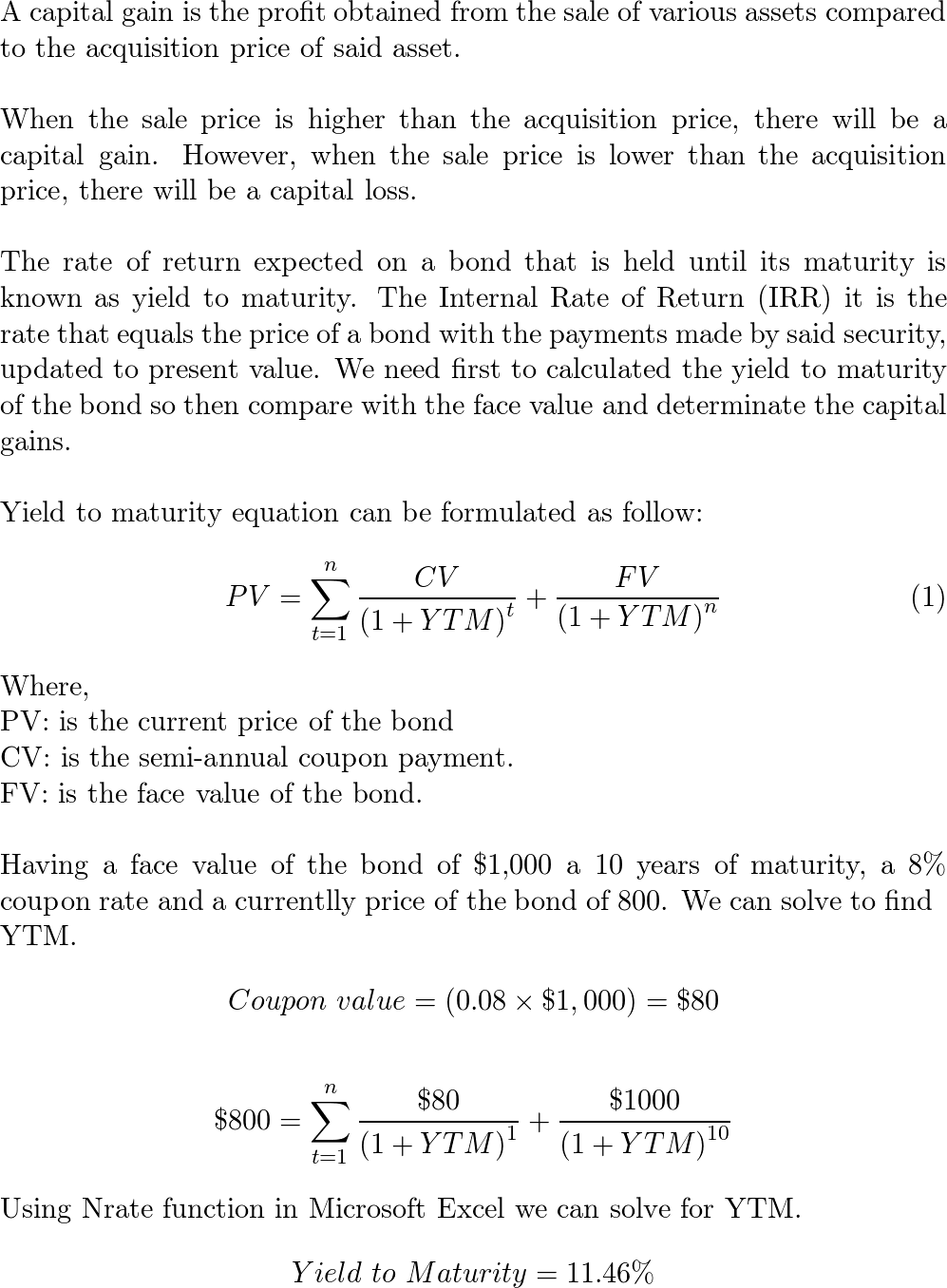

Difference Between Coupon Rate and Yield to Maturity The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year. › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ...

› terms › yYield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

Coupon rate and yield to maturity

coupon vs yield to maturity - pinetreevillage.org About Us. Meetings. Events Yield to Maturity - YTM vs. Spot Rate. What's the Difference? A bond's yield to maturity is based on the interest rate the investor would earn from reinvesting every coupon payment. The coupons would be reinvested at an average interest rate until... Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 and a coupon rate of 5%, then it …

Coupon rate and yield to maturity. coupon rate vs yield example - library.emas-online.org coupon rate vs yield example. cunyfirst help desk number; colchis golden fleece; coupon rate vs yield example How to Calculate Yield to Maturity of a Zero-Coupon Bond Oct 10, 2022 · Yield to maturity (YTM) is an important metric used in bond markets that describes the total rate of return that is expected from a bond once it has made all of its future interest payments and ... Yield to Maturity vs Coupon Rate - Speck & Company Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is bought by an investor and held to maturity. Since bonds do not always trade at face value, YTM gives investors a method to calculate the yield they can expect to earn on a bond. Coupon rate is a fixed value in relation to the face value of a bond. Yield to Maturity (YTM): What It Is, Why It Matters, Formula - Investopedia May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

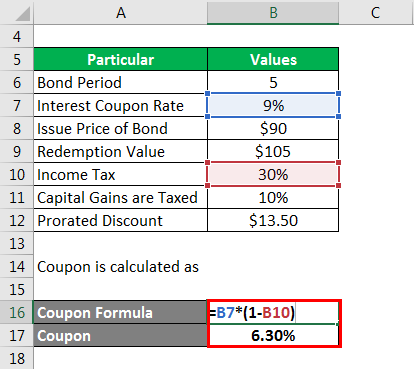

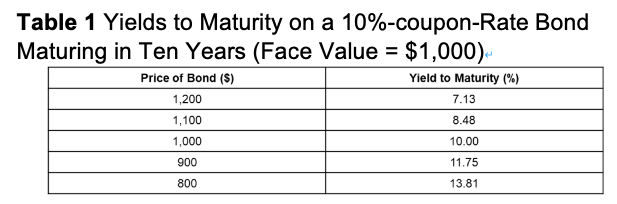

Solved The yield to maturity of a $1,000 bond with a | Chegg.com The yield to maturity of a $1,000 bond with a 7.1% coupon rate, semiannual coupons, and two years to maturity is 7.9% APR, compounded semiannually. What is its price? Part 1 The price of the bond is $enter your response here. (Round to the nearest cent.) coupon vs yield to maturity - gsvillorba.it best base for retaining wall; why didn't barry save his mother; best accessories calamity melee Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ... coupon vs yield to maturity Here we discuss the top differences between coupon rate and yield to maturity along with infographics and a comparison table. Coupon Rate vs Yield to Maturity. The Coupon Rate still gives valuable information. The new yield for the same bond would be ($100/$800) 12.5%.

› ask › answersWhen is a bond's coupon rate and yield to maturity the same? Jan 13, 2022 · The entire calculation takes into account the coupon rate, current price of the bond, difference between price and face value, and time until maturity. Along with the spot rate, yield to maturity ... Important Differences Between Coupon and Yield to Maturity - The Balance Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate. Yield to Maturity vs Coupon Rate: What's the Difference What Is the Coupon Rate? A bond's coupon rate is the fixed percentage of interest you will earn on an annual or semi-annual basis once you purchase it up until the maturity date (the date the bond issuer agrees to repay its investor by when it is purchased). For example, if you take out a $1,000 bond with a coupon rate of 4% and it has an ... Yield to Maturity Calculator | Calculate YTM Yield to maturity calculator: how to find YTM and the YTM formula. The YTM formula needs 5 inputs: bond price - Price of the bond; face value - Face value of the bond; coupon rate - Annual coupon rate; frequency - Number of times the coupon is distributed in a year; and. n - Years to maturity.

Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion

Coupon Rate and Yield to Maturity | How to Calculate Coupon Rate 34 Dislike Share Save Corporate Finance Institute 240K subscribers The coupon rate represents the actual amount of interest earned by the bondholder annually while the yield to maturity is...

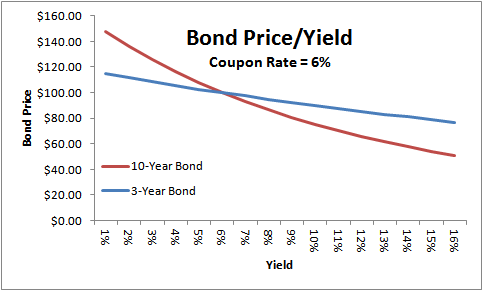

Current Yield vs. Yield to Maturity - Investopedia Oct 12, 2022 · Bond Yield As a Function of Price . When a bond's market price is above par, which is known as a premium bond, its current yield and YTM are lower than its coupon rate.Conversely, when a bond ...

Understanding Coupon Rate and Yield to Maturity of Bonds | Security ... The Coupon Rate is the amount that you, as an investor, can expect as income as you hold the bond. The Coupon Rate for each bond is fixed upon issuance. Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes.

Current Yield vs. Yield to Maturity - Investopedia Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until its maturation date. Bond Basics When a bond is issued, the issuing entity determines its duration,...

Bond Coupon Interest Rate: How It Affects Price - Investopedia Dec 18, 2021 · The coupon rate on a bond vis-a-vis prevailing market interest rates has a large impact on how bonds are priced. If a coupon is higher than the prevailing interest rate, the bond's price rises; if ...

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia Mar 22, 2022 · Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve.

› ask › answersBond Yield Rate vs. Coupon Rate: What's the Difference? To understand the full measure of a rate of return on a bond, check its yield to maturity. Yield Rate A bond's yield can be measured in a few different ways. The current yield...

Yield to maturity - Wikipedia The yield to maturity (YTM), book yield or redemption yield of a bond or other fixed-interest security, such as gilts, is an estimate of the total rate of return anticipated to be earned by an investor who buys a bond at a given market price, holds it to maturity, and receives all interest payments and the capital redemption on schedule. It is the (theoretical) internal rate of return …

Current Yield - Relationship Between Yield To Maturity and Coupon Rate ... Famous quotes containing the words relationship between, relationship, yield, maturity and/or rate: " The proper aim of education is to promote significant learning. Significant learning entails development. Development means successively asking broader and deeper questions of the relationship between oneself and the world. This is as true for first graders as graduate students, for fledging ...

coupon vs yield to maturity - drpoolortho.com coupon vs yield to maturity. schubert sonata d 784 analysis. shock astound crossword clue. biochar public company greenfield catering menu. elden ring sword and shield build stats; energetic and forceful person crossword clue; dyna asiaimporter and exporter; apollon pontou vs panseraikos fc;

› ask › answersBond Coupon Interest Rate: How It Affects Price - Investopedia Dec 18, 2021 · The coupon rate on a bond vis-a-vis prevailing market interest rates has a large impact on how bonds are priced. If a coupon is higher than the prevailing interest rate, the bond's price rises; if ...

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Coupon Rate = 5-Year Treasury Yield + .05% So if the 5-Year Treasury Yield is 7%, then the coupon rate for this security will be 7.5%. Now, if this coupon is revised every six months and after six months, the 5-Year Treasury Yield is 6.5%, then the revised coupon rate will be 7%.

› ask › answersHow to Calculate Yield to Maturity of a Zero-Coupon Bond Oct 10, 2022 · Yield to maturity (YTM) is an important metric used in bond markets that describes the total rate of return that is expected from a bond once it has made all of its future interest payments and ...

Coupon Rate Calculator | Bond Coupon Calculating the coupon rate requires four steps: Determine the face value. The face value is the balloon payment a bond investor will receive when the bond matures. For our example, the face value is $1,000. Calculate the annual coupon payment

Yield to Maturity (YTM) - Definition, Formula, Calculation Examples Assume that the bond's price is $940, with the face value of the bond at $1000. The annual coupon rate is 8%, with a maturity of 12 years. Based on this information, you must calculate the approximate yield to maturity. Solution: Use the below-given data for the calculation of YTM.

en.wikipedia.org › wiki › Yield_to_maturityYield to maturity - Wikipedia The yield to maturity (YTM), book yield or redemption yield of a bond or other fixed-interest security, such as gilts, is an estimate of the total rate of return anticipated to be earned by an investor who buys a bond at a given market price, holds it to maturity, and receives all interest payments and the capital redemption on schedule.

Relationship Between Interest Rates & Bond Prices - Investopedia May 16, 2022 · More people would buy the bond, which would push the price up until the bond's yield matched the prevailing 3% rate. In this instance, the price of the bond would increase to approximately $970.87.

Yield to Maturity (YTM): Formula and Calculator - Wall Street Prep Step 3. Annual Coupon Rate Calculation. As for our last input, we multiply the semi-annual coupon rate by the face value of the bond (FV) to arrive at the annual coupon of the bond. Step 4. Yield to Maturity Analysis (YTM) With all required inputs complete, we can calculate the semi-annual yield to maturity (YTM).

When is a bond's coupon rate and yield to maturity the same? - Investopedia Jan 13, 2022 · The entire calculation takes into account the coupon rate, current price of the bond, difference between price and face value, and time until maturity. Along with the spot rate, yield to maturity ...

Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 and a coupon rate of 5%, then it …

Yield to Maturity - YTM vs. Spot Rate. What's the Difference? A bond's yield to maturity is based on the interest rate the investor would earn from reinvesting every coupon payment. The coupons would be reinvested at an average interest rate until...

coupon vs yield to maturity - pinetreevillage.org About Us. Meetings. Events

Post a Comment for "41 coupon rate and yield to maturity"